As discussed in the Q2 2021 letter, we thought inflation would be higher than what markets were implying as well as what the Federal Reserve was forecasting. For 2023 and beyond, I believe there is a significant probability that inflation and interest rates will be much higher than what is being predicted by the Federal Reserve or the professional forecasters. Incidentally, my forecasts of higher interest rates are somewhat lower than the interest rates provided by the Taylor Rule which prior to the pandemic tracked the federal funds rate very well, and which in each of the three default alternatives chosen by the Atlanta Fed is dictating a federal funds rate in the 7% to 8% range. John Taylor is also personally advocating for very large increases in the Federal Funds rate to maximize the utility of households.1

I have several reasons for thinking that inflation is going to be higher than the Federal Reserve is predicting. They mainly involve problems with the inflation model used by the Fed and by professional forecasters. I will also be discussing the ability of the Federal Reserve to address inflation under current conditions. I will conclude with a discussion of how my analysis could be mistaken: in particular the reasons there may be a large increase in private saving or unanticipated increases in private output that could offset the supply/demand imbalances that would otherwise be driving inflation.

What is omitted from this discussion is any treatment of recent events in Ukraine and the sanctions against Russia. This omission is not because I think that these events will have no major effects on inflation and on interest rates, but rather because I don’t think that at the present time I have anything interesting to say about how the Federal Reserve will respond to higher commodity prices. I would, however, point out that Russia produces around 40% of the world’s palladium and that its main use is in catalytic converters; thus a curtailment of exports of palladium from Russia could meaningfully affect the car industry.

A Critique of the Standard Phillips Curve Model

There are several problems with the standard Phillips model, which macro-economists use to forecast inflation. At the core of the basic Phillips curve model is the assumption that future inflation can be forecast using a linear function of three variables: the current inflation rate, expectations of future inflation, and the ratio of unemployment to the natural rate of unemployment. It assumes that the linear relationship that is estimated from past data (plus some controls that each modeler adds to their basic model) will predict future inflation.

There are some fundamental problems with this approach. Not only is the functional form of the model ad hoc but important drivers of inflation are omitted. Among the factors omitted in the standard model that I shall discuss as affecting future inflation include the following: excess savings of households, wealth effects on future spending from the increase in housing prices, equity prices and bond prices; lagged effects of the Consumer Price Index for Urban Wage Earners and Clerical Workers (“CPI-W”) on retirements and spending by retirees;2 future budget deficits and their effects on spending; effects of the Fed broadcasting its expectations of a series of future interest rate increases (these announcements could cause households to increase home purchases to lock in low mortgage rates or conversely to increase savings and decrease debt due to a fear of a “hard landing”); private sector quit rates and job opening rates that are not captured by the unemployment rate; rationing of manufactured goods; large recent increases in commodity prices.

Fundamental Problems with the Model and Omitted Variables

The economy is changing so relationships that held in the past may not hold today. It has been roughly 40 years since we last had inflation at the levels we are currently experiencing.3 Job openings and private sector quit rates are higher than they’ve been since those data were first gathered. Real interest rates are far lower than anything we have seen in the past. The federal government deficits are higher than any peace time levels. The aggregate stock of assets held by the Federal Reserve and other central banks relative to GDP of the relevant economies is higher than anything we have ever experienced. Forecasts by professional forecasters are typically based on data that does not include the extreme economic conditions we are currently experiencing as determinants. Their empirical models instead extrapolate from the data that is available. These extrapolations are likely to be unreliable. For instance, historically government deficits in peace time were small relative to what we have experienced in the last two years, and the revenue shortfalls were due either to tax cuts to wealthy individuals with low marginal propensities to consume, or falls in revenue due to a recession and its aftermath hurting tax collections and increasing spending on entitlements. (During World War II there were price controls.)

Economics is not physics. We don’t run experiments on the economy, and natural experiments can’t be relied upon since market participants will learn from that experience and respond differently the next time similar conditions arise. On the other hand, we should not ignore all the data from the past. It is useful, but should be used judiciously.

While we need to rely on some estimates from past experience, we should keep in mind that the current economic environment is very dissimilar to what we have seen in the past. Rather than relying on bad models to get precise but highly inaccurate and possibly highly biased estimates of future inflation and interest rates, it could be more productive to think broadly about what factors are likely to be affecting interest rates and inflation in the next few months or years.

My basic assumption for predicting interest rates is that over long periods of time prices tend toward equilibrating supply and demand: if there is serious excess demand at current prices I’d expect prices to increase, unless the Fed responds to the indicators of forthcoming inflation by causing a deflationary recession.4 Later in this missive, I shall also address the question of how effective interest rate policy will be in halting inflation under current economic circumstances.

Deficit Spending

The U.S. federal deficit is forecast by the Economist Intelligence Unit to be 7.4% of GDP in 2022.5 This estimate came out when predictions of increases in interest rates were much lower. The expected increase in interest rates will boost the deficit; furthermore the end of QE and the possible sale of securities by the Federal Reserve will decrease payments by the Federal Reserve to Treasury and thus further increase the budget deficit.

While starting after the end of the Clinton administration the government has been running deficits, and those deficits have been growing, they have been modest fractions of GDP relative to the size of deficits in recent years (the implied deficits from future social security obligations were large but so too were the predicted future gains in GDP).6 The increase in deficits in recent years aside from deficits during the global financial crisis and the recent pandemic were generated largely by reductions in the top tax brackets for individuals, and the 2017 cuts in the corporate profits tax. The corporations used most of the revenue either to increase their savings or to pay dividends or buyback their stock, so the deficits from the Trump tax cuts and the Trump payouts to businesses at the start of the pandemic were largely offset by increases in private savings.

The spending from the $1.9 trillion Biden stimulus bill is very different; it is putting more cash in the hands of people with high marginal propensities to consume. Low and middle income people have more of their wealth in variable interest savings accounts and have fixed interest rate mortgages so the increases in interest rates will tend to increase their share of spendable income as will increased spending on infrastructure and social services. Even though budget deficits were offset by high levels of private savings in the past, as the budget deficit approaches double digits there is a risk of inflation spinning out of control. A recent survey by Ricardo Reis that he discussed in Markus Brunnermeier’s webinar, found that a significant fraction of respondents thought inflation from 2027-2032 would exceed 10%.7 These responses may be influenced by the looming budget deficits. Note that even prior to the pandemic, and the accompanied rise in the government debt, the Wharton-Penn model was forecasting deficits going to 10% of GDP by 2050.

Excess Savings and Wealth Effects

Another missing factor in the standard Phillips curve inflation forecast is excess savings. Since the start of the epidemic there has been a large increase in aggregate savings. The savings rate has returned to roughly pre-pandemic levels, but the accumulated savings has not decreased significantly. Unless precautionary savings increases, this accumulated savings will be spent, increasing demand and putting pressure on prices.

There have also been increases in the net wealth of people across the income distribution due to increases in home prices, stock market prices and bond prices. The largest component of household wealth is housing, and housing prices have been booming over the last 10+ years. The S&P total return index from end-February 2009 to March 9, 2022 is up around 650%; the NASDAQ total return index is up around 970% over the same period. Even with the correction of stock prices in recent weeks the recent performance of equities has been very strong. The prices of bonds have also risen steadily since their lows in the early 1980s. While most of these gains accrue to the wealthy, many middle income households benefit through their IRAs and pension savings that are invested in a combination of equities and bonds.

Reduction in debt service expenses have also increased the disposable income of people. Over the last few years homeowners have been able to refinance their homes at more favorable interest rates. The stimulus packages and overall increases in savings rates have resulted in reductions in credit card debt. Interest rates on that debt have also decreased. The combined effects have been that fixed interest payments as a fraction of disposable income are at all-time lows. Increases in the disposable income has the potential to increase spending and thus push up prices.

According to media accounts, the credit card companies are actively trying to increase their lending through mailings of credit cards, and cuts in interest rates. This is due in part to the better financial position of most households and also due to fewer opportunities to lend money to safe borrowers. The increased availability of credit can increase spending causing another source of upward pressure on prices.

Reductions in Labor Supply

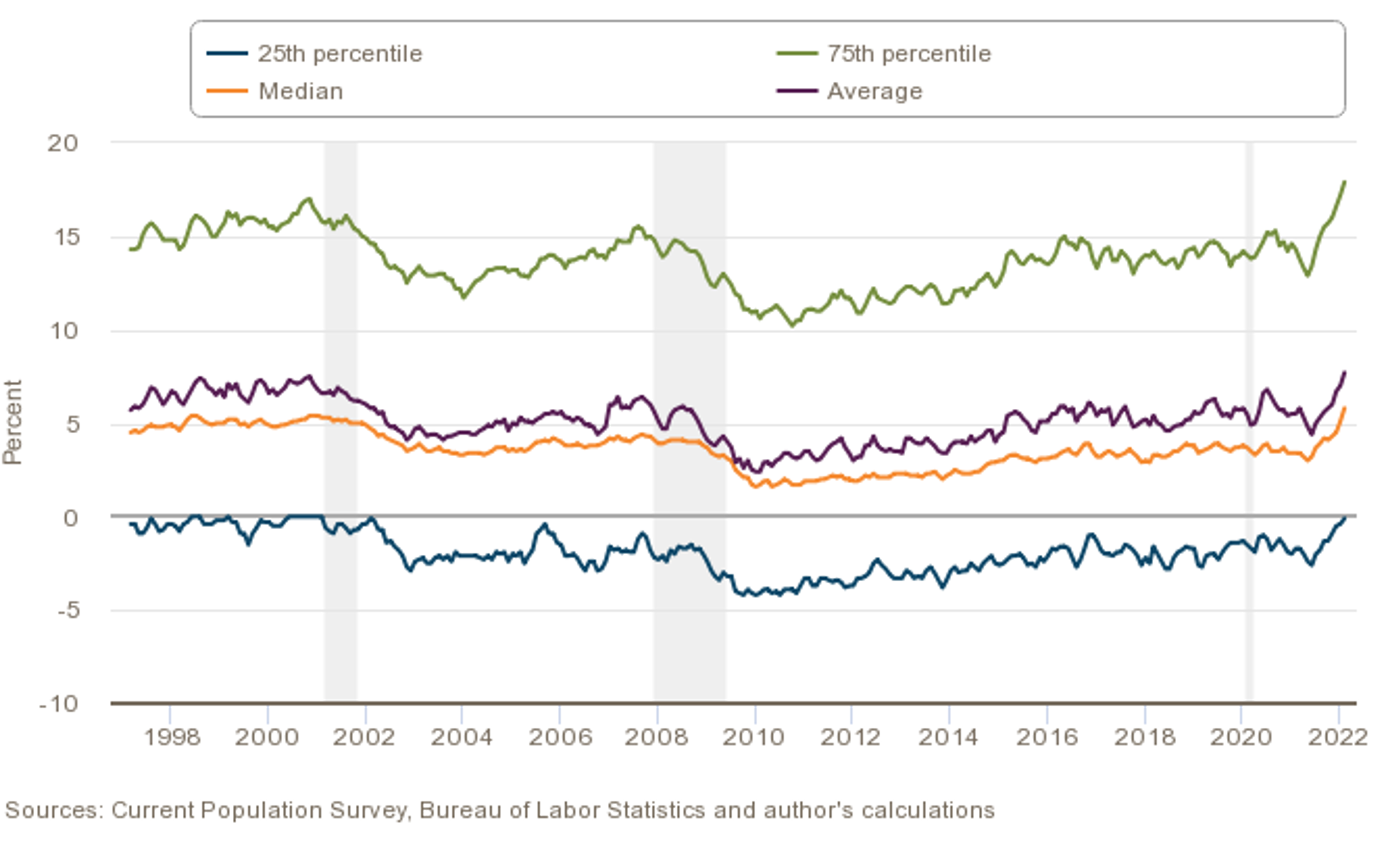

The main change in labor supply has come from a reduction in the labor force participation rates. There has been an abnormal amount of the labor force which has retired. Wages have increased sharply in January and February of 2022. The Atlanta Fed uses a panel set of respondents to measure the change in the wages of the same people from one year to the next. This avoids changes in the labor force composition that typically underestimate wage changes as new participants tend to have lower wages. Looking at changes of the mean average wage change for the latest 3 month period compared to the wages 12 months ago, those wages are up 7.7%. The wage gain has accelerated in recent months as can be seen in the chart below.8 The wage gains are greater for higher wages workers (the average is the average of the wage gains not the average wage gain) and thus the increase in spendable income is greater than 7.7%. Wages are also truncated at the level that would generate annual income of $150,000. This truncation further reduces the average wage gain and causes the wage increase to be understated.

Distribution of Year-Over-Year Individual Wage Growth (Federal Reserve Bank of Atlanta)9

We expect that the increase in wages will have a smaller effect on the labor force participation rate of older workers than would normally be the case. There are continuing increases in the benefits from retirement versus working. For example, social security payments increased by 5.9% in January reflecting the increase in the CPI-W from the end of September 2020 through the end of September 2021. If the changes in the CPI-W from end of September to end of February were to continue at the same annualized rate, social security benefits in January 2023 would increase by 9%. The CPI-W has been increasing—it grew by 0.9% in February. Increases in social security benefits are likely to keep the transitions from retirement back to the labor force at the low levels we have observed in recent years.10 Tax brackets are linked to the Consumer Price Index for All Urban Consumers (“CPI-U”) which has also been increasing at a rapid rate (a year-on-year growth in February of 7.9%). The implied rent on owner occupied housing has been growing more slowly than other components of the CPI, thus the current cost of living is growing faster than would be indicated by the CPI number, but as rents on new leases become reflected in average rents that trend will provide an impetus for further increases in cost-of-living adjustments. Note that the Producer Price Index (“PPI”), which is the cost that firms charge for goods and services, has been increasing significantly faster than the CPI or the PCE, the latter being the main measure of inflation used by the Federal Reserve.10

Another driver of incentives to retirement is changes in the benefit from employer provided health care. Obamacare subsidies for individual health care contracts, and increased coverage of Medicaid by most states, lower the cost of retirement for people who don’t yet qualify for Medicare. We have observed that once we correct for the changes in the age distribution between the 2010 and 2020 census, the labor force participation rate of workers over 55 has continued to be significantly below its levels prior to the pandemic.12 The labor force participation rate of younger workers has almost completely recovered to its pre-Covid levels. Thus the lower labor force participation of older workers seems likely to be due to retirements or possibly to the effects of long-haul COVID and may persist. Long-haul COVID may decrease the productivity of workers and thus may reduce effective labor supply apart from its effects on employment.13

Lastly, the gains in asset values discussed as a driver of future spending and thus on inflation are not reflected in the savings data, but they increase the ability of people to support themselves through asset sales, and, thus will enable middle and higher income older workers to withdraw from the labor force without having to unduly decrease their spending. Decreases in output due to retirements that are not fully offset by decreases in spending puts upward pressure on wages and prices. As discussed above, we are already seeing higher wages in the Atlanta Fed data, which tracks the wages of the same people over a 12-month period and thus avoids the biases from changes in the composition of the labor force. Note that the media interpreted the most recent wage data as indicating a flattening in the growth of wages: this divergence can be explained by the large increase in employment in the leisure and hospitality sectors which have among the lowest wages of any sector.

Problems with the Phillips Curve Model Variables

Having presented a number of important variables that are omitted from the Phillips Curve model, I will discuss in turn each of the variables that are in the model.

Inflation as a Predictor

The various indices of inflation don’t actually do a very good job of measuring changes in the cost of living, i.e. changes in disposable income that would be needed to sustain the same standard of living. For the CPI, roughly ¼ of its weight is the implied rent of owner-occupied housing—increases in the implied rent will eventually affect the cost of living but even that effect is muted by the inheritance of dwellings by the children of the previous generation of owners. They are not paying the new higher implied rent of housing if they either live in the dwelling they inherit, or sell it for an equivalent dwelling. The PCE has a smaller but still substantial component of owner-occupied housing. It also includes the cost of medical services provided by firms. The PCE is of particular importance because it is the main measure of inflation used by the Federal Reserve in deciding on whether the economy is overheating.

Average rents, including the implicit rent on owner occupied housing, is almost 1/3 of the CPI. Rental contracts are typically of at least a year’s duration. Rents on new leases have been increasing very sharply. The effect on average rent is lagged; even if the rents on new leases were to stop increasing, average rents would increase as contracts are renewed.

The rental vacancy rate in the 4th quarter of 2021 was 5.6%, the lowest level since 1984.14 According to RealPage, the vacancy rate in November 2021 for apartments was reported even lower at approximately 2.5% and, when there is a turnover of tenants, rents increased by 13.9% as of November on a year-on-year basis.15 There have been similar increases in asking rents for new leases—Zillow and Apartment List each reported increases of well over 15% year over year by the end of 2022.16 This effect of annual or bi-annual rental contracts will provide continued pressure on inflation as measured by the CPI for many months if not years to come.

The cost of health care services is subject to agreed-upon contracts between insurers and the government on the one side and providers on the other. Since these contracts are fixed for some time period, the prices of government and insurance provided health care tend to adjust more slowly to inflationary pressures than most other services, but are likely to catch up or even exceed the price increases in other sectors.

The cost of education has also been rising more slowly than other components of the PCE. This may be due to falls in expenditures on transportation, after school activities, and substitute teachers and early retirement of more senior teachers (who are generally higher paid) due to COVID. I would expect that expenditures on education to increase post COVID.

Although rent has a smaller weight in the PCE than in the CPI, it is still substantial, and the lagged effects discussed for the CPI will also affect the PCE in future months. Unless careful and judicious adjustments are made, these lagged effects on the PCE will affect the Federal Reserve’s models of future inflation and thus may affect future interest rates as reported inflation comes in higher than would be expected if the lagged effects of increases in rents on new leases were not taken into account. While the lagged effects of rent increases are fairly predictable, there is much more uncertainty about future changes in health care and education and also more uncertainty about how Federal Reserve policy will respond to these lagged effects compared to the deterministic response of social security payments and tax brackets to changes in CPI-W and CPI-U respectively.

The trimmed inflation rate has historically been a good predictor of future inflation.17 When inflation is low prices do not change very often: this is especially true of prices of services so movements in prices by some providers can be a good indicator of future price movements by other providers. Prices of energy and food tend to respond very quickly to changes in supply and thus are unlikely to exhibit these lagged effects, which may be why the Phillips curve models have traditionally focused on core inflation, which excludes energy and food prices. (The conventional argument for excluding energy and food prices is that they are volatile, this may just mean that imbalances in the supply/demand for energy or food have immediate effects on prices and thus are not predictive of future price changes).

When inflation is high, prices change more frequently, which changes the relationship between current inflation and future inflation. At low rates of inflation people don’t expect price changes and thus will be sensitive to them, making prices sticky—they are more likely to search for another supplier than when prices are regularly increasing. At moderate rates of inflation such as we are currently experiencing people are accustomed to price increases and firms can increase prices without having the same effects on their customers and customer loyalty as when the customers are accustomed to rigid prices. When inflation gets very high firms can index prices, wages, rents and other long-term contracts to measures of inflation. With full indexing there is almost no lag between current price increases and future price increases.

Except for social security payments and various inflation indexed securities, we have very little indexing in the current economy. Thus the lengths of lags are important particularly for the rental and health care components of the price indices. The very large increases in rents on new leases will continue to have large lagged effects on average rents as used in the CPI. As discussed above, there are also lagged effects from health insurance contracts that tend to only be repriced annually. Although health costs are not rising rapidly, the ratio of employees in medical services to revenues has fallen dramatically which seems likely to result in higher wages and higher health costs in the future, these effects impact future inflation as medical service contracts get signed at higher costs. If we are going to use current inflation as a predictor we should consider the details. In particular if we want to predict the inflation as measured by the CPI or PCE, then instead of using average rents in the inflation component of the Phillips curve we should be using rents on new leases.

We should also adjust current measures of inflation to reflect quantity rationing: the “price” of a good or service that is not currently available is somewhat meaningless. Since the CPI uses past purchases as weights, this distortion can be significant (the PCE is a chained linked index which mitigates, but does not eliminate this problem). Of course, we can’t get precise measures of the shadow price of these rationed goods and services, but a precise measure of a meaningless number is not very useful. Similarly, shortages of glass or of wiring harnesses from Ukraine or platinum or nickel from Russia may limit production of some cars or other goods, creating a reservoir of unfilled demand that will put pressure on prices in the future.

Inflation as measured by the PCE (which is a national price index) has other measurement issues under current conditions. It gives biased measures of supply/demand imbalances when there is large scale migration from high-cost regions (urban centers in California and the Northeast) to lower cost regions of the economy (such as rural areas, exurbs, and states with lower cost of living). Prices in both cities and rural areas could be increasing and inflation as measured by the PCE falling, if the local price increases was outweighed by a larger share of consumption occurring in lower cost locations. While, this scenario is highly unlikely, migration effects do cause the PCE to under-estimate the inflation experienced by individuals who do not migrate, and the people migrating are presumably closer to indifferent between living in the high-cost urban area versus low-cost rural areas or southern states. There is another effect which is that the cost-of-living indices are not fully capturing changes in the prices of goods and services purchased by very wealthy people which could eventually be reflected in increased purchasing power and increased purchases by the providers of those goods and services.

Inflationary Expectations

Expectations of future inflation is usually estimated using consumer survey data18 or using the data from the market for TIPS.19 The simplistic model of inflation expectations is that when people expect there to be inflation, they will buy today in anticipation of prices being higher tomorrow. Likewise, firms will invest more in inventory today and parts to get ahead of future price increases, and be willing to pay higher wages today because they think they will sell their goods for more tomorrow. Unions will negotiate for higher wage increases to compensate for future price increases. To the extent that older workers anticipate increases in their social security benefits due to cost-of-living adjustments, firms will be incentivized to increase their wages today.

While the simplistic dynamic may hold some of the time, it does not take into account people’s anticipation of Fed policy in response to higher inflation. If a high level of expected inflation is associated with a greater probability of a recession due either to contractionary monetary policy or Minsky effects of excessive risk-taking during booms, it may be rational for firms and consumers to reduce their risk exposure when they anticipate high inflation.

A reasonable response by consumers is to increase savings rates and to defer purchases of consumer durables, especially ones which decrease future disposable income.20 Yuriy Gorodnichenko has found that consumers in the U.S. and elsewhere associate high inflation with falls in GDP, and that in a randomized control trial, when consumers were given data that lead them to increase their inflation expectations, they reduced spending on durables.

Even if consumers are uncertain about whether inflation will lead to a Fed induced recession versus a price increase without a recession, a risk averse consumer would still increase savings if they think the probability of a recession is higher.

The effects for producers are similar: they may be reluctant to make investments if they think the probability of a Fed induced recession is higher when expected inflation is higher.

Potential buyers of bonds may anticipate higher interest rates as the Fed tightens in response to inflation. They would then demand higher interest rates today, pushing up the cost of borrowing for firms. The higher borrowing costs will decrease investment thus decreasing demand and lowering prices. Potential buyers of bonds may also demand a higher risk premium due to the increased risk of a Fed induced recession that would cause a higher rate of default on bonds. Higher interest rates may increase defaults by marginal firms even in the absence of a recession. Firms that can’t get financing are likely to curtail investment and hiring thus decreasing aggregate demand.

In summary, counter to the usual logic that anticipation of higher prices and interest rates causes an increase in spending, it could instead decrease spending. I’m not arguing that when expected inflation will increase that spending will contract and thus the economy automatically stabilizes. What I am suggesting is that the response of consumers and firms to higher rates of expected inflation could vary widely depending on how they believe the Federal Reserve will respond and how they believe other firms and consumers are likely to change their behavior in response to higher expected rates of inflation. Historical data may not be very informative in estimating the coefficient of expected inflation in the Phillips curve.

Slack in the Economy as Reflected in the Difference Between Unemployment and the Natural Rate of Unemployment

Most inflation forecasting models assume a natural rate of unemployment of 4%. This is below the unemployment level for almost every month pre-pandemic in the last 20+ years. The natural rate of unemployment is driven by job searching and, as such, is mainly a function of the fraction of young adults and teenagers in the labor force. Unemployment rates fall very sharply going from the 16-21 age group to the over-30 age group. The retirement of older workers increases the percentage of young workers and, thus, increases the natural rate. Thus, even if you believe the difference between the unemployment rate and the natural rate of unemployment is the best indicator of slack in the economy and of future wage growth then if we adjust the natural rate of unemployment, we would find that there is much less slack than would be suggested by assuming the natural rate of unemployment is 4%.

However, I think that the difference between the unemployment rate and the natural rate of unemployment is a poor estimate of labor market tightness and overall slack. Job openings or alternatively quits have each been far better predictors of inflation than is the difference between unemployment and the natural rate of unemployment.21 In my discussions with macroeconomists, the argument for using the divergence of unemployment from the natural rate as a measure of slack in the economy is that we don’t have data on job openings or quits going back past 2000. I don’t think that is a very good argument for ignoring all recent data on job openings and quits.

The measures presented by the Atlanta Fed indicate historically high levels of labor market tightness—in many cases the labor tightness measures are at, or close to, the maximum level in the data.22

The private sector job vacancy rate to private sector employment is roughly twice its long run average since 2000 and every month since February 2021 has been higher than in any month prior to February 2021 since records began in 2000. Similarly, over the last year, private sector job vacancies and private sector quit rates have been steadily above the levels seen prior to the pandemic and are well above their long-run averages.

It seems reasonable to expect that employers are going to raise wages if they can’t retain their current workers or fill vacancies, and that this would be a more pressing concern than the unemployment rate. The unemployment rate is affected by the age distribution of the labor force composition, accumulated savings, two earner households and other factors that do not directly affect the incentives for firms to increase wages.

A key metric of the labor market that will affect aggregate demand as well as the marginal cost of supplying goods and services is the change in wages, holding the composition of the labor force fixed. As previously discussed, workers are experiencing greater wage increases than would be inferred from the numbers reported in the media.

Comments on the Ability of the Fed to Address Inflation

Sensitivity of Employment to Changes in Interest rates: U.S. Car Production

Moderate increases in interest rates have their effects through changes in employment in the automobile industry and the residential construction industry—both of which are highly sensitive to interest rates. U.S. car production ranged between 8 million and 10 million cars per year prior to the pandemic. Production of motor vehicles was close to 10 million in the period before the Fed slammed on the breaks in the late 1970s. The increases in interest rates by the Volker Fed led to a fall in U.S. car production to 4 million cars per year. Currently, U.S. auto production is below 2 million cars per year. U.S. Automotive manufacturing sales are estimated to be around $86 billion in 2022.23 This is comparable in order of magnitude to the increase in payments to social security recipients from the cost-of living adjustment in January and the expected adjustment next January. Automotive manufacturing is a much less important contributor to the U.S. economy than it was in the past. It is currently the 136th largest industry in the U.S., and the 13th largest manufacturing industry.24 We don’t have comparable data from the 1970s, but automobile manufacturing was probably the largest manufacturing industry at that time. The decrease in the importance of automobile manufacturing in the U.S. economy is due in part to the longer use value of cars caused by higher quality (the average car in the U.S. is currently expected to stay in use for 20 years) and an increase in imports as a fraction of total sales.

Residential Housing

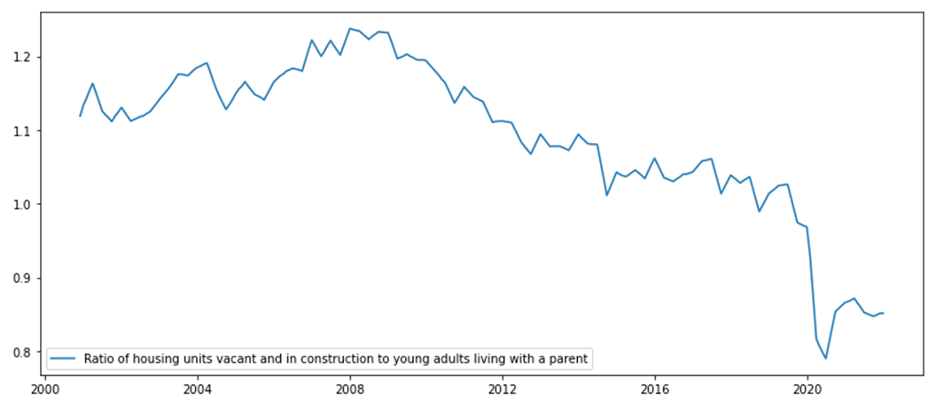

Turning now to residential housing, the other industry in which historically interest rates have had a major impact. This industry has not fallen as a share of GDP so a crash in housing starts would have a large impact on total demand. However, there are some peculiar features of the recent housing market. Despite the large increase in home prices, housing starts have not increased very much at around 1.7 million. As a fraction of the working age population, housing starts are well below their long run average—they are following an upward trend after falling sharply after the great financial crisis.25 If we consider vacancies plus homes under construction as a fraction of adults under 25 living with their parents, this ratio has been hovering around its historical low indicating large unfilled demand for housing.

Ratio of Housing Units Vacant and in Construction to Young Adults 16-25 Living with a Parent26

The lack of an increase in housing starts, despite the increase in housing prices and the increase in rents, seems likely to be due to the sharp increase in the cost of construction that has accompanied the increase in housing prices. I would expect that the fall in demand for housing from an increase in interest rates is likely to be mitigated by a fall in the prices of the inputs to construction. There are high job vacancy rates in the construction industry so even if demand for housing were to fall it is not clear that there would be major reductions in employment in the housing sector. Furthermore, there is likely to be increased demand for construction workers from the infrastructure bill. Thus, it seems as though the effect of moderate increases of interest rates on employment in the construction industry may be to merely offset the demand for construction workers from the $500 billion in spending in the infrastructure bill.

The bottom line is that it seems unlikely that the contemplated increases in interest rates will be sufficient to bring inflation down to the levels assumed by market participants. The Federal Reserve can crush inflation if it takes interest rates high enough, but it may need to go to levels of interest rates that are not politically feasible due to the effects on bankruptcies of small and medium sized business that finance themselves through variable interest rate bank loans.

Data That May Cause My Predictions to Be Wrong

The following could derail my predictions. They can be grouped into two broad categories: factors that could increase private savings and thus dampen demand, and factors that could increase output and thus increase supply.

- The fear of future pandemics, or civil unrest around the 2024 election could lead to high levels of private savings, and especially savings in safe assets such as treasuries or TIPS. This high savings rates could decrease demand.

- A fear that when the Medicare and social security trust funds run out of money, benefits will be cut, which could lead to large increases in precautionary savings.

- The income distribution could get even more unequal with more of the income going to people with high savings rates.

- A fear that the Federal Reserve will raise interest rates to levels that will cause massive job losses and business failures could lead to high savings rates by individuals and firms and lower demand.

- Events in Ukraine increasing risk aversion and flight to safety pushing up savings rates and lowering interest rates on government bonds.

- Fed Policy triggering a recession

- Increased life expectancy of high-income individuals and increased incidence of costly age-related diseases as people live longer will cause high income people to increase their savings rates. These same factors could cause high income, high productivity people to remain in the labor force for longer, thus increasing labor supply.

- After the pandemic subsides, retirees could rejoin the labor force thus decreasing the vacancy rates.

- Immigration policy could change to allow in more productive workers, thus increasing labor supply.

- Over the course of the next few years, increased use of self-driving trucks, use of drones for deliveries, and more use of robots in warehouses could alleviate pressures on labor supply and enable more efficient allocations of resources.

- A strong dollar perhaps due to higher interest rates or to a flight to safety from events in Ukraine could lower the price of imports of goods and services.

Summary

There is considerable uncertainty about future inflation, but the standard models are seriously flawed, and even the more sophisticated models do not seem to adequately capture the risk of extreme events. They are explicitly assuming either normal distributions or log normal distributions, while the historical distributions typically have high degrees of kurtosis, and, at least for interest rates, skewness is inherent in any model with high variance and interest rates being bounded somewhere above -1%.

I would urge caution in buying any assets that are vulnerable to high nominal interest rates. I would also urge caution in not assuming a Normal (bell shaped) probability distribution of future interest rates or inflation (very high nominal interest rates are more likely than very negative ones). I’d also urge caution in assuming that the Federal Reserve will be able to hit its inflation target of 2%. I hope it can, but would not bet on it.

Sincerely,

Andrew Weiss | CEO, Weiss Asset Management

Disclaimers:

This commentary has been prepared by Dr. Andrew Weiss and reflects the opinions of Dr. Weiss. This is not an offer to sell, nor a solicitation of an offer to buy any security of any fund (a “Fund”) managed by Weiss Asset Management LP or its affiliates (“WAM”) or any other investment product or strategy. Offers to sell or solicitations to invest in a Fund are made only by means of a confidential offering memorandum and in accordance with applicable securities laws. An investment in a Fund involves a high degree of risk and is suitable only for sophisticated investors that are qualified to invest therein. Commodity trading involves a substantial risk of loss.

This commentary may not be reproduced or further distributed without the written permission of Dr. Weiss. This material has been prepared from original sources and data believed to be reliable. However, no representations are made as to the accuracy or completeness thereof.

Although not generally stated throughout, this commentary reflects the opinion of Dr. Weiss, which opinion is subject to change and neither Dr. Weiss nor WAM shall have any obligation to inform you of any such changes.

This commentary includes forward-looking statements, including projections of future economic conditions. Neither Dr. Weiss nor WAM makes any representation, warranty, guaranty or other assurance whatsoever that any of such forward-looking statements will prove to be accurate. There is a substantial likelihood that at least some, if not all, of the forward-looking statements included in this commentary will prove to be inaccurate, possibly to a significant degree.